The Big Short

Year: 2015

Runtime: 130 min

Language: English

Director: Adam McKay

Budget: $28M

When the housing market shows signs of instability, eccentric investor Michael Burry recognizes the impending crisis and makes a risky bet against it. His unusual prediction draws the interest of a resourceful banker and a wary hedge-fund manager. Together, they team up to profit from the looming economic downfall, navigating the complexities of the financial world and ultimately capitalizing on the ensuing collapse.

Warning: spoilers below!

Haven’t seen The Big Short yet? This summary contains major spoilers. Bookmark the page, watch the movie, and come back for the full breakdown. If you're ready, scroll on and relive the story!

Timeline – The Big Short (2015)

Trace every key event in The Big Short (2015) with our detailed, chronological timeline. Perfect for unpacking nonlinear stories, spotting hidden connections, and understanding how each scene builds toward the film’s climax. Whether you're revisiting or decoding for the first time, this timeline gives you the full picture.

Last Updated: November 08, 2024 at 01:21

Explore Movie Threads

Discover curated groups of movies connected by mood, themes, and story style. Browse collections built around emotion, atmosphere, and narrative focus to easily find films that match what you feel like watching right now.

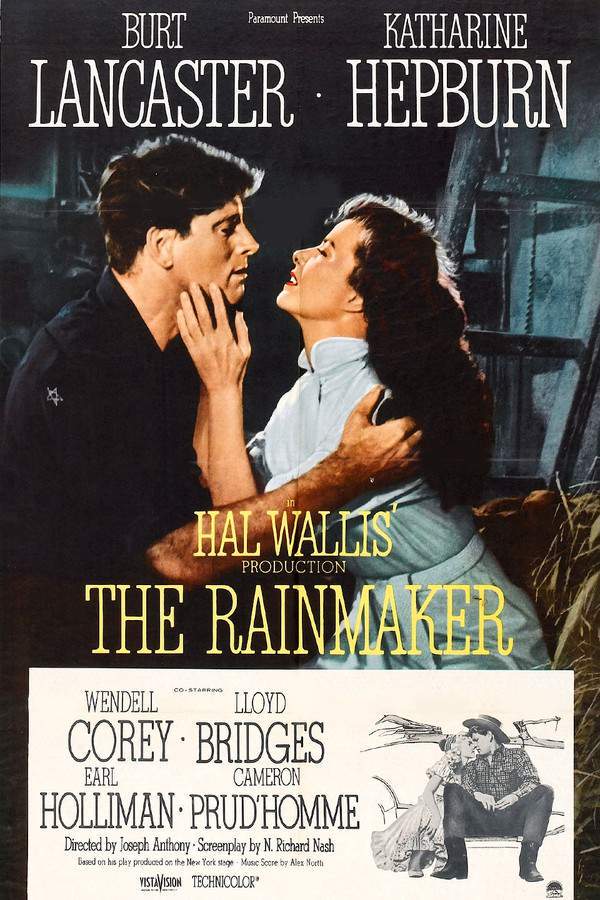

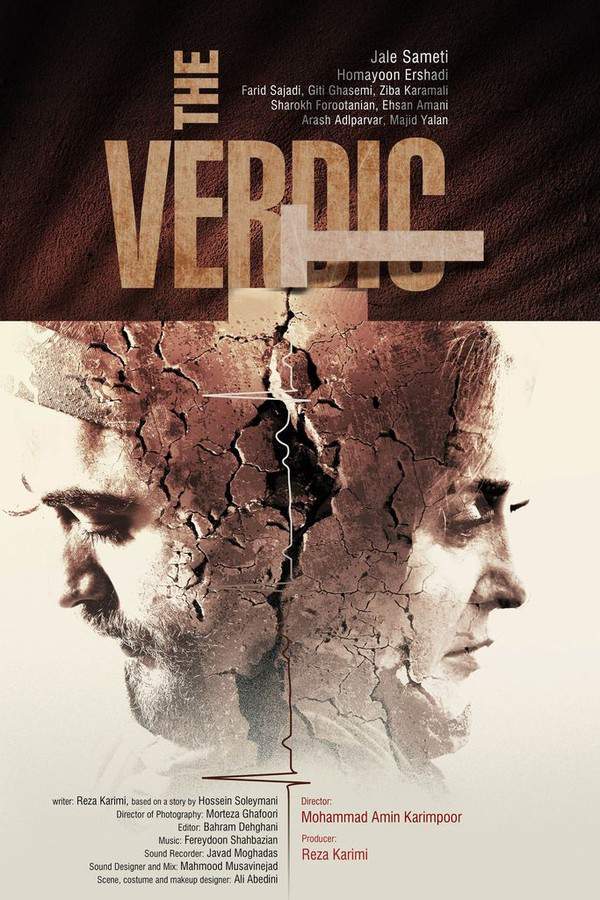

Movies that expose complex systems like The Big Short

Films that dive deep into complex systems to reveal the rot at the core.If you liked how The Big Short broke down the housing crisis, you'll appreciate these films that dissect complex systems. This collection includes movies like Margin Call and Spotlight, where characters uncover systemic corruption and navigate the tense fallout, perfect for fans of intelligent, high-stakes dramas.

Narrative Summary

Stories in this thread typically involve a character or group discovering a critical vulnerability or act of fraud within a large, seemingly stable system. Their journey is one of investigation and validation, often against disbelief from the establishment, leading to a climax where the truth emerges with significant consequences.

Why These Movies?

These films are grouped by their shared focus on explaining complex, real-world systems to the audience, combined with a tense, investigative narrative and a tone of moral outrage. They deliver a gripping experience that is both intellectually stimulating and emotionally charged.

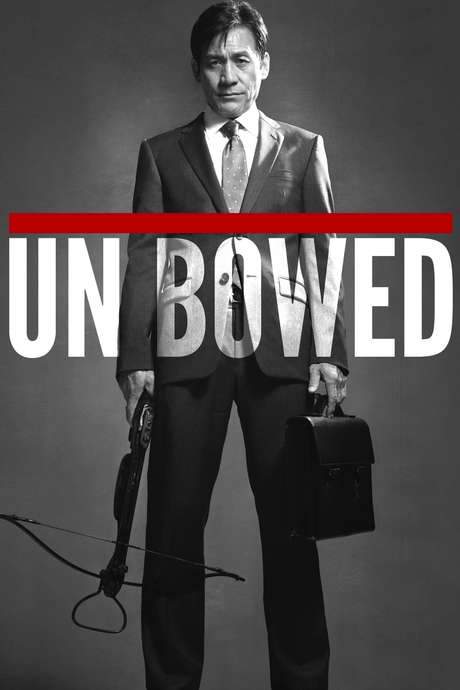

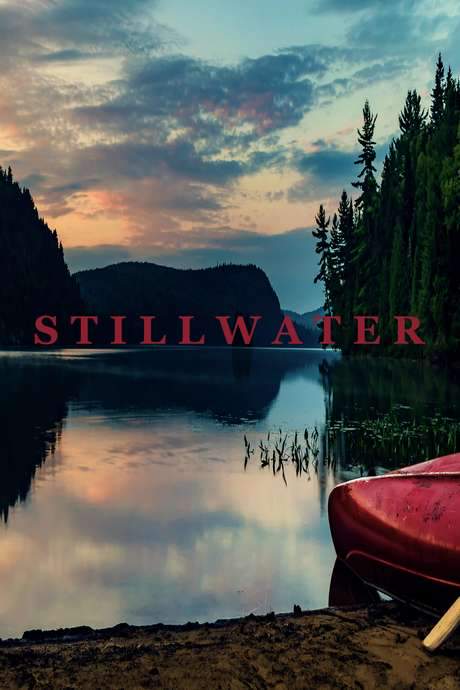

Movies with bittersweet victories like The Big Short

Stories where being proven right comes with a heavy moral price.Find more films with morally complex endings like The Big Short. These movies feature characters who succeed in their goals but are left with guilt or disillusionment. If you appreciated the poignant ending where financial gain was overshadowed by human cost, explore these similar dramatic journeys.

Narrative Summary

The narrative pattern follows characters who pursue a goal based on a correct but grim prediction or principle. They ultimately succeed, but their triumph is hollow, as they are forced to confront the devastating real-world consequences of being right, leading to a finale filled with moral ambiguity rather than celebration.

Why These Movies?

Movies in this thread share a specific emotional arc: the blend of intellectual victory with profound moral discomfort. They resonate because they explore the complex aftermath of success, creating a powerful, thought-provoking, and bittersweet viewing experience.

Unlock the Full Story of The Big Short

Don't stop at just watching — explore The Big Short in full detail. From the complete plot summary and scene-by-scene timeline to character breakdowns, thematic analysis, and a deep dive into the ending — every page helps you truly understand what The Big Short is all about. Plus, discover what's next after the movie.

The Big Short Summary

Read a complete plot summary of The Big Short, including all key story points, character arcs, and turning points. This in-depth recap is ideal for understanding the narrative structure or reviewing what happened in the movie.

Characters, Settings & Themes in The Big Short

Discover the characters, locations, and core themes that shape The Big Short. Get insights into symbolic elements, setting significance, and deeper narrative meaning — ideal for thematic analysis and movie breakdowns.

The Big Short Ending Explained

What really happened at the end of The Big Short? This detailed ending explained page breaks down final scenes, hidden clues, and alternate interpretations with expert analysis and viewer theories.

The Big Short Spoiler-Free Summary

Get a quick, spoiler-free overview of The Big Short that covers the main plot points and key details without revealing any major twists or spoilers. Perfect for those who want to know what to expect before diving in.

More About The Big Short

Visit What's After the Movie to explore more about The Big Short: box office results, cast and crew info, production details, post-credit scenes, and external links — all in one place for movie fans and researchers.

Similar Movies to The Big Short

Discover movies like The Big Short that share similar genres, themes, and storytelling elements. Whether you’re drawn to the atmosphere, character arcs, or plot structure, these curated recommendations will help you explore more films you’ll love.

Explore More About Movie The Big Short

The Big Short (2015) Plot Summary & Movie Recap

The Big Short (2015) Scene-by-Scene Movie Timeline

The Big Short (2015) Ending Explained & Theories

The Big Short (2015) Spoiler-Free Summary & Key Flow

Movies Like The Big Short – Similar Titles You’ll Enjoy

Inside Job (2010) Full Movie Breakdown

The Wolf of Wall Street (2013) Story Summary & Characters

Margin Call (2011) Ending Explained & Film Insights

The Banker (2020) Film Overview & Timeline

Get Shorty (1995) Story Summary & Characters

The Big Picture (1989) Spoiler-Packed Plot Recap

Wall Street: Money Never Sleeps (2010) Full Movie Breakdown

Small Time Crooks (2000) Story Summary & Characters

Wall Street (1987) Full Movie Breakdown

The Bank (2002) Full Movie Breakdown

Dumb Money (2023) Full Movie Breakdown

Billion (2019) Full Movie Breakdown

The Big Swindle (2004) Plot Summary & Ending Explained

The Big Gamble (1931) Complete Plot Breakdown

The Bank Shot (1974) Spoiler-Packed Plot Recap