Too Big to Fail

Year: 2011

Runtime: 97 mins

Language: English

Director: Curtis Hanson

Through interviews and archival footage, the documentary follows how Main Street suffered while Wall Street profited, offering an intimate examination of the 2008 financial crisis. It concentrates on the powerful men and women whose swift decisions over a few weeks shaped the global economy and affected the lives of ordinary people.

Warning: spoilers below!

Haven’t seen Too Big to Fail yet? This summary contains major spoilers. Bookmark the page, watch the movie, and come back for the full breakdown. If you're ready, scroll on and relive the story!

Too Big to Fail (2011) – Full Plot Summary & Ending Explained

Read the complete plot breakdown of Too Big to Fail (2011), including all key story events, major twists, and the ending explained in detail. Discover what really happened—and what it all means.

In 2008, the global financial picture is grim, and television screens flood with images of a tightening crisis around the mortgage market. The early shock comes with the forced sale of Bear Stearns to JPMorgan Chase under government guarantees, a move meant to stem the panic but also a signal that trouble in large financial firms is no longer isolated. As Bear Stearns fades from the stage, Lehman Brothers becomes the next looming test, its stock price tumbling while potential buyers hesitate. Dick Fuld, Lehman’s chief executive, fights to keep the company afloat by insisting that the real estate assets be kept off the negotiating table, a stance that gradually narrows the field of viable options and fuels concerns about the bank’s true value.

Across Washington, the mood is urgent and divided. Henry Paulson, the U.S. Treasury Secretary, and Timothy Geithner, the President of the Federal Reserve Bank of New York, convene amidst a storm of negotiations, pressing the leaders of the nation’s biggest banks to underwrite a rescue package that could restore confidence and liquidity to the system. The banks respond with a cautious calculus: a government backstop would be essential for any large-scale rescue, yet political and regulatory walls stand in the way. The most promising U.S.-based buyer for Lehman, Bank of America, appears ready to act only with Fed involvement, but policymakers remain wary of putting the taxpayer at risk again.

As the weekend unfolds, the high-stakes meeting among bank chiefs becomes a focal point for the crisis. The group signals a willingness to act collectively to stabilize the financial core, but a series of setbacks derail the plan. Bank of America withdraws from the Lehman deal, choosing instead to acquire Merrill Lynch, which shifts the playing field toward a different set of implications for the market. Attempts to engage Barclays in a rescue move are blocked by British regulators, underscoring how intertwined and global the problem has become. With no satisfactory path to a government-backed deal, Lehman Brothers files for bankruptcy, a turning point that transforms a private crisis into a systemic catastrophe.

The consequences ripple outward with alarming speed. The stock market falters, investor confidence evaporates, and the broader financial system shows signs of strain. At the same time, insurance giant AIG teeters on the brink of failure, prompting a swift government response. Christine Lagarde, then France’s finance chief, warns that allowing AIG to fail would extend the crisis across Europe, highlighting the international reach of the American collapse. The government responds decisively with an $85 billion loan, a decision described as preventing a “too big to fail” scenario and illustrating how the policy toolbox expands as the crisis deepens.

Back in the United States, the central banks push for decisive legislative action. Ben Bernanke, Chair of the Federal Reserve, argues that Congress must authorize continued intervention to prevent a deeper economic catastrophe, even as the credit markets tighten further. With liquidity becoming scarce, Paulson’s plan shifts toward buying toxic assets to clear the banks’ balance sheets, a move designed to free up capital and encourage lending. The administration and Congress engage in a protracted negotiation, racing against time as markets threaten to plunge further. The drama around congressional action intensifies when political events intrude: Senator McCain publicly suspends his campaign to return to Washington and participate in the deliberations, adding political urgency to the fiscal debate. The exchanges grow tense as factions debate the scope and speed of relief, and the looming question remains whether policy can outpace the downturn.

As the crisis deepens, a framework begins to take shape. Bernanke and Paulson advocate for a legislative package that would empower the Treasury to intervene more directly, culminating in a structured plan known as the Troubled Asset Relief Program (TARP). The team with Treasury support and the FDIC, led by Sheila Bair, outlines a strategy that includes mandatory capital injections for banks to bolster lending and restore the flow of credit to households and businesses. Although the initial approach grapples with political resistance and practical obstacles, the sense of a concrete pathway begins to emerge, even as the details and timelines remain fiercely contested.

Within the cast of key players, several high-stakes conversations unfold around specific institutions and individuals. [Ben Bernanke], a steadying voice at the Fed, emphasizes that stabilization depends on clear legislative backing and credible plans to keep credit moving. He appears alongside [Henry Paulson], whose role in shaping policy and public messaging becomes central to the administration’s response to the crisis. The narrative also centers on the leadership of the banking world: figures like Jamie Dimon and others weigh in on what the industry can bear and what it expects in return for support. The drama also follows the quiet calculations of executives such as John Thain and Christopher Cox, who are forced to consider how risk, valuation, and governance intersect with national policy during this unprecedented moment.

Across the narrative, the human toll and the systemic implications are laid bare. Lehman’s collapse exposes how intertwined the financial network has become, prompting a cascade of scrutiny over compensation, risk management, and the incentives that fed the crisis. Warren Buffett and other veteran observers weigh the lessons in risk, accountability, and moral hazard, reminding viewers that the consequences of policy choices extend far beyond any single firm. The film also traces the broader ramifications for the workforce and the economy, as the credit crunch tightens and households feel the squeeze of tighter lending standards and reduced access to funds for everyday needs.

In the end, the policy response yields a mix of relief and questions. The emergency interventions help stabilize some markets, but the epilogue notes that banks leveraged only a fraction of the funds to revive consumer credit, while executive compensation in the post-crisis climate remains high. The narrative closes on a cautious note: the crisis is contained, but not erased, and the path forward requires a careful balance between safeguards, incentives, and the ongoing vigilance of policymakers, regulators, and the banking industry.

The film ultimately offers a sober, intricate portrait of a moment when decisions at the highest levels of government and finance carried the weight of millions of livelihoods, showing how crisis, policy, and market forces collided in a way that reshaped the global economy for years to come. The tension between urgency and prudence, between bold action and restraint, plays out in every negotiation, every vote, and every public statement, leaving viewers with a nuanced understanding of how one of the most dramatic chapters in financial history unfolded.

Last Updated: October 09, 2025 at 15:34

Explore Movie Threads

Discover curated groups of movies connected by mood, themes, and story style. Browse collections built around emotion, atmosphere, and narrative focus to easily find films that match what you feel like watching right now.

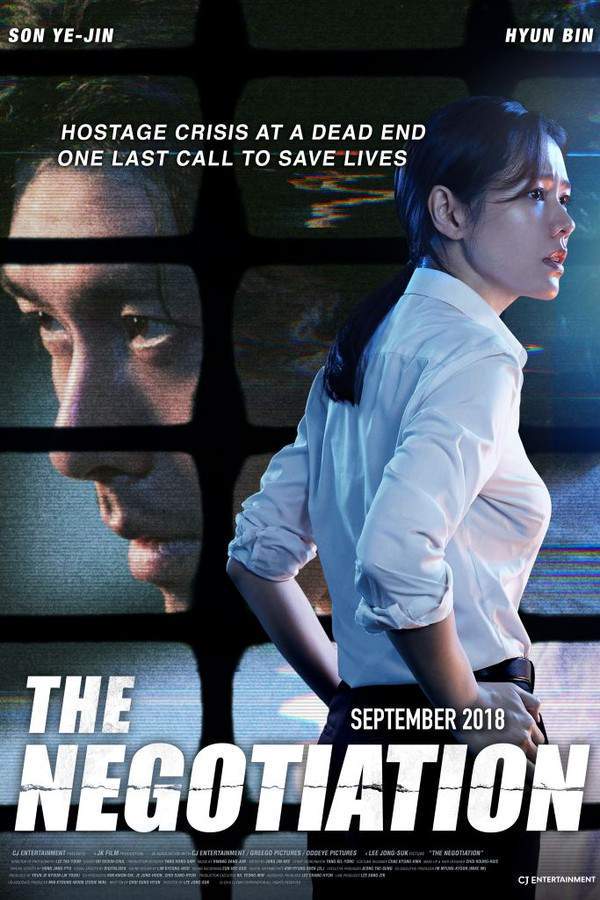

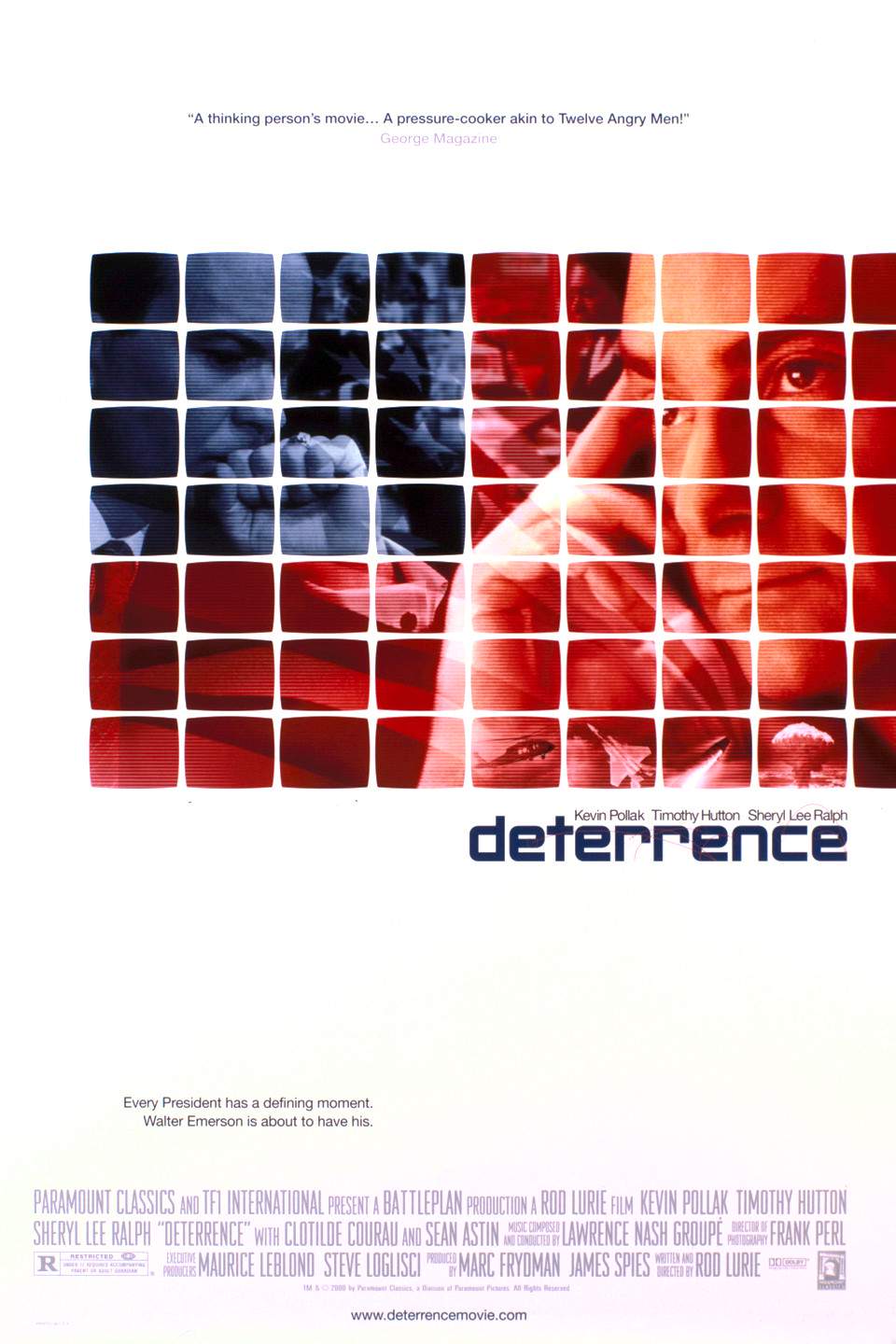

Crisis management movies like Too Big to Fail

Stories of powerful figures racing against time to avert systemic collapse.If you liked the high-stakes tension of Too Big to Fail, explore other movies like it that delve into real-world crises. These similar films focus on procedural drama, rapid-fire decision-making, and the heavy burden of leadership during events that threaten to collapse entire systems.

Narrative Summary

These narratives often unfold in real-time or over a condensed, urgent period. They follow a large ensemble of characters, usually based on real people, as they navigate a cascade of escalating problems. The conflict is less about physical danger and more about intellectual, political, and ethical challenges, where a single misstep can have catastrophic global consequences.

Why These Movies?

Movies are grouped here for their shared focus on tense, fast-paced procedural storytelling during a major crisis. They deliver a sober, gripping, and anxious viewing experience defined by high-stakes negotiations, complex systemic problems, and the heavy weight of responsibility.

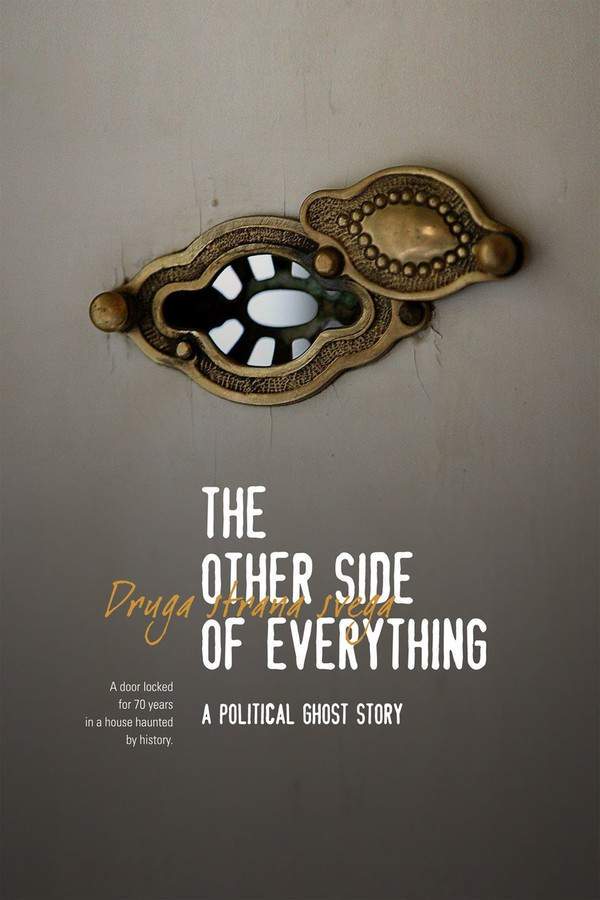

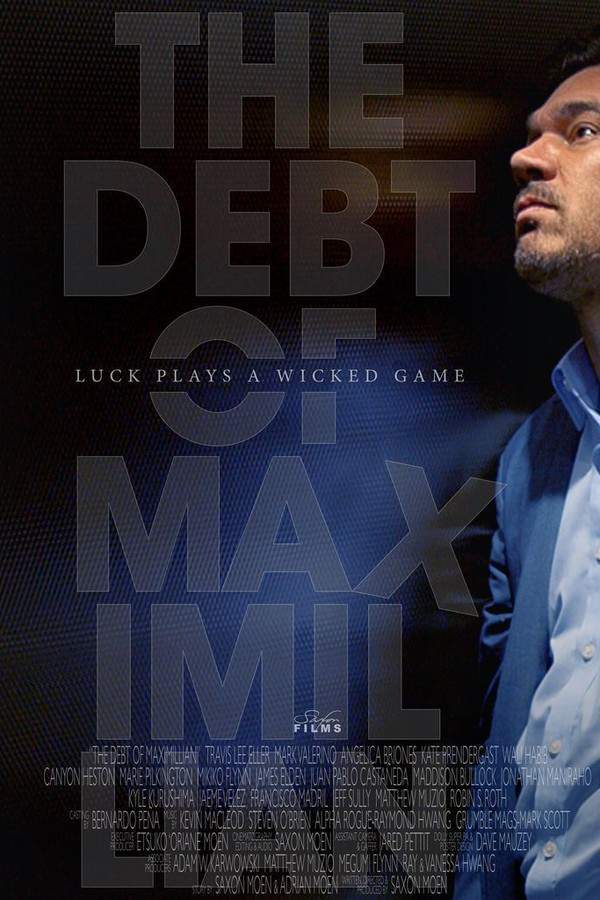

Systemic analysis dramas like Too Big to Fail

Unflinching examinations of flawed systems that leave you with uneasy questions.Fans of Too Big to Fail who appreciate its deep dive into a complex system will enjoy these similar movies. These films offer a sobering look at how large-scale systems operate, fail, and are patched up, often ending on a bittersweet note that questions the true cost of stability.

Narrative Summary

The narrative pattern involves peeling back the layers of a complex institution to reveal the interconnected causes of a major failure. The journey is one of discovery and grim realization, where solving the immediate crisis often comes at the cost of addressing the root causes, leading to an ending that mixes relief with cynicism or unease.

Why These Movies?

These films are connected by their analytical approach to storytelling, heavy emotional weight, and a shared tone of sober contemplation. They prioritize understanding a complex problem over simple heroics, resulting in a similar bittersweet and thought-provoking feeling long after the credits roll.

Unlock the Full Story of Too Big to Fail

Don't stop at just watching — explore Too Big to Fail in full detail. From the complete plot summary and scene-by-scene timeline to character breakdowns, thematic analysis, and a deep dive into the ending — every page helps you truly understand what Too Big to Fail is all about. Plus, discover what's next after the movie.

Too Big to Fail Timeline

Track the full timeline of Too Big to Fail with every major event arranged chronologically. Perfect for decoding non-linear storytelling, flashbacks, or parallel narratives with a clear scene-by-scene breakdown.

Characters, Settings & Themes in Too Big to Fail

Discover the characters, locations, and core themes that shape Too Big to Fail. Get insights into symbolic elements, setting significance, and deeper narrative meaning — ideal for thematic analysis and movie breakdowns.

Too Big to Fail Spoiler-Free Summary

Get a quick, spoiler-free overview of Too Big to Fail that covers the main plot points and key details without revealing any major twists or spoilers. Perfect for those who want to know what to expect before diving in.

More About Too Big to Fail

Visit What's After the Movie to explore more about Too Big to Fail: box office results, cast and crew info, production details, post-credit scenes, and external links — all in one place for movie fans and researchers.