Too Big to Fail

Year: 2011

Runtime: 97 mins

Language: English

Director: Curtis Hanson

Through interviews and archival footage, the documentary follows how Main Street suffered while Wall Street profited, offering an intimate examination of the 2008 financial crisis. It concentrates on the powerful men and women whose swift decisions over a few weeks shaped the global economy and affected the lives of ordinary people.

Warning: spoilers below!

Haven’t seen Too Big to Fail yet? This summary contains major spoilers. Bookmark the page, watch the movie, and come back for the full breakdown. If you're ready, scroll on and relive the story!

Timeline – Too Big to Fail (2011)

Trace every key event in Too Big to Fail (2011) with our detailed, chronological timeline. Perfect for unpacking nonlinear stories, spotting hidden connections, and understanding how each scene builds toward the film’s climax. Whether you're revisiting or decoding for the first time, this timeline gives you the full picture.

Last Updated: October 09, 2025 at 15:34

Explore Movie Threads

Discover curated groups of movies connected by mood, themes, and story style. Browse collections built around emotion, atmosphere, and narrative focus to easily find films that match what you feel like watching right now.

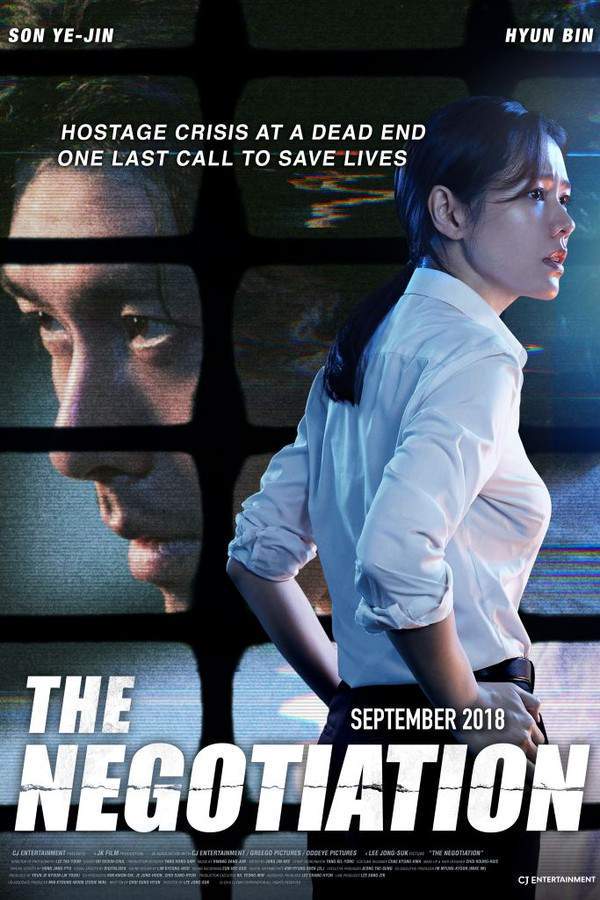

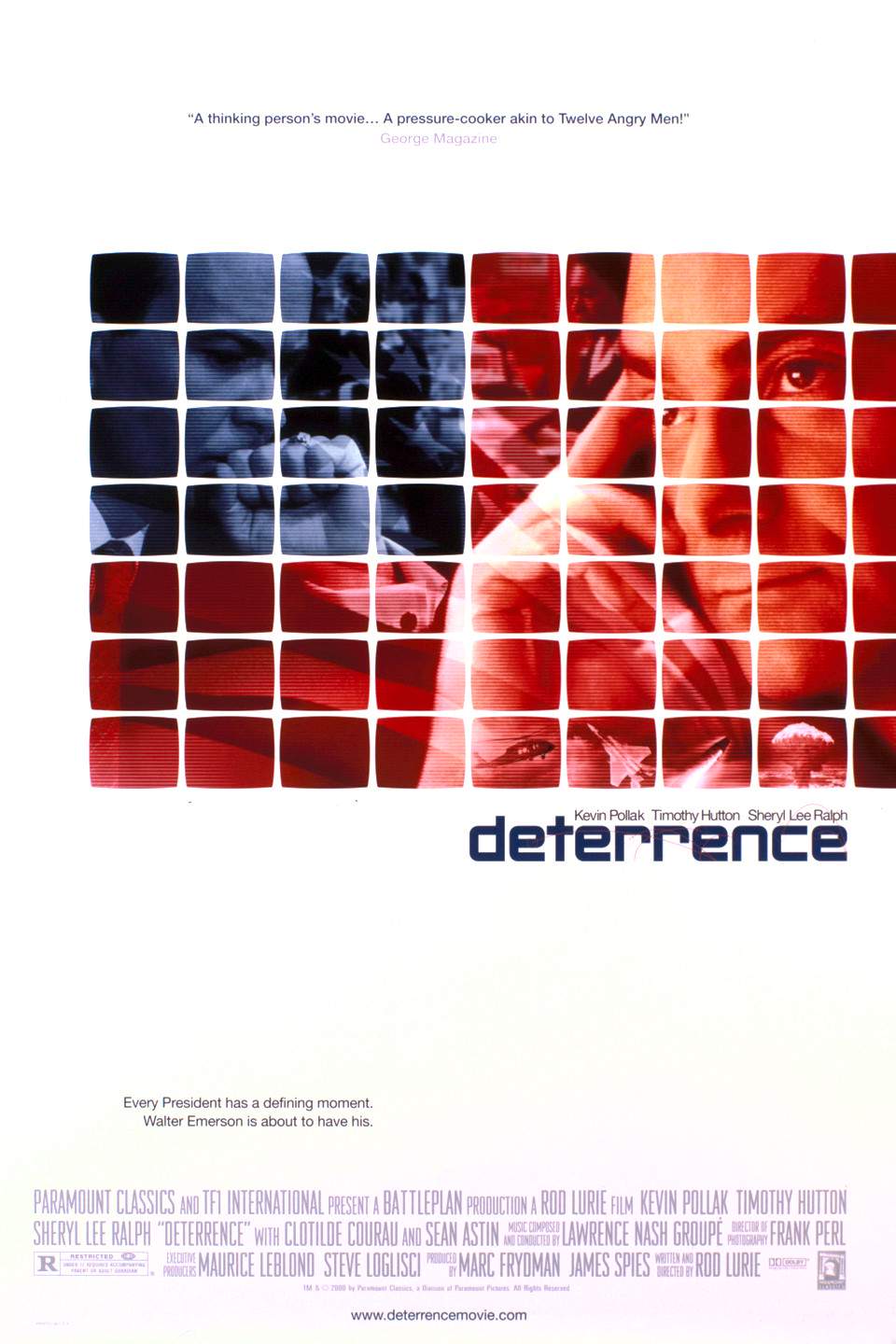

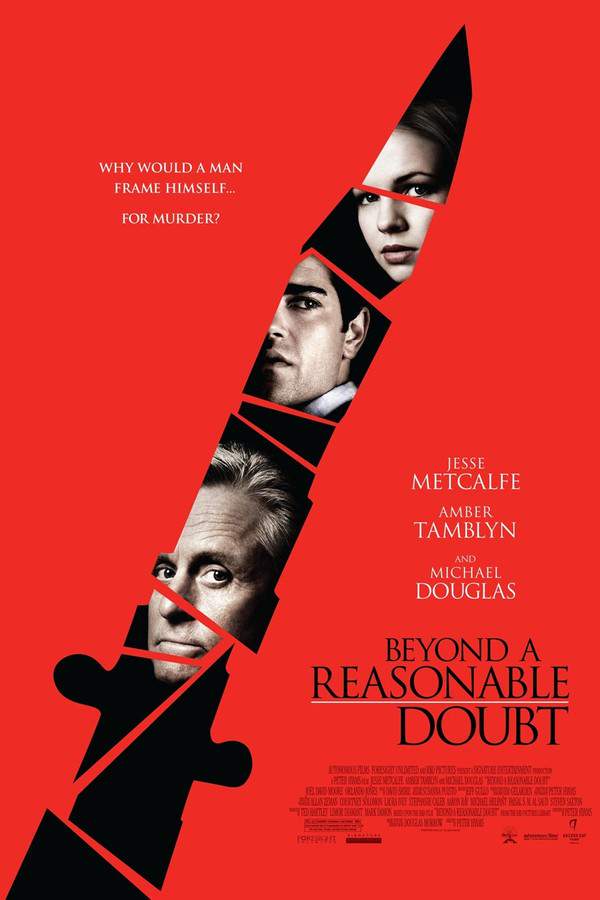

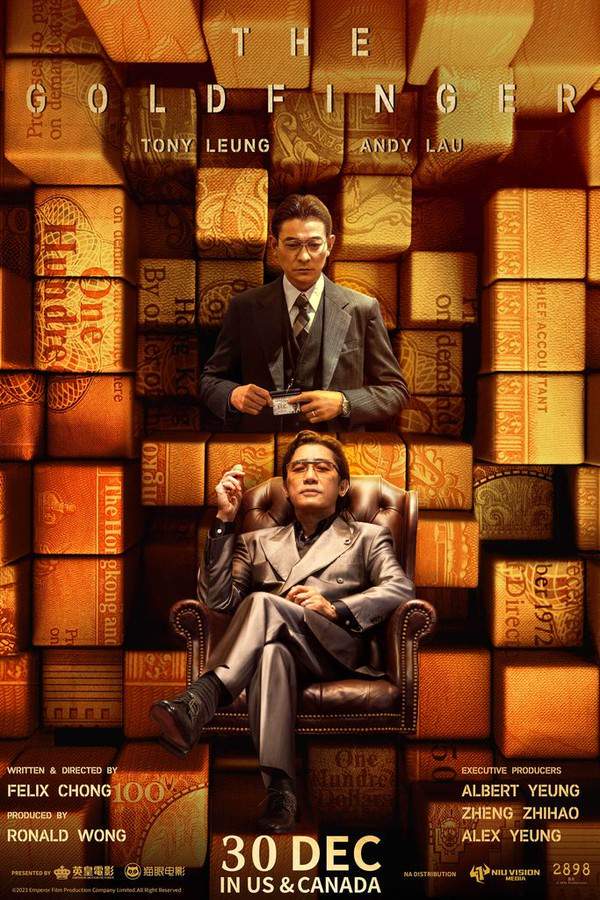

Crisis management movies like Too Big to Fail

Stories of powerful figures racing against time to avert systemic collapse.If you liked the high-stakes tension of Too Big to Fail, explore other movies like it that delve into real-world crises. These similar films focus on procedural drama, rapid-fire decision-making, and the heavy burden of leadership during events that threaten to collapse entire systems.

Narrative Summary

These narratives often unfold in real-time or over a condensed, urgent period. They follow a large ensemble of characters, usually based on real people, as they navigate a cascade of escalating problems. The conflict is less about physical danger and more about intellectual, political, and ethical challenges, where a single misstep can have catastrophic global consequences.

Why These Movies?

Movies are grouped here for their shared focus on tense, fast-paced procedural storytelling during a major crisis. They deliver a sober, gripping, and anxious viewing experience defined by high-stakes negotiations, complex systemic problems, and the heavy weight of responsibility.

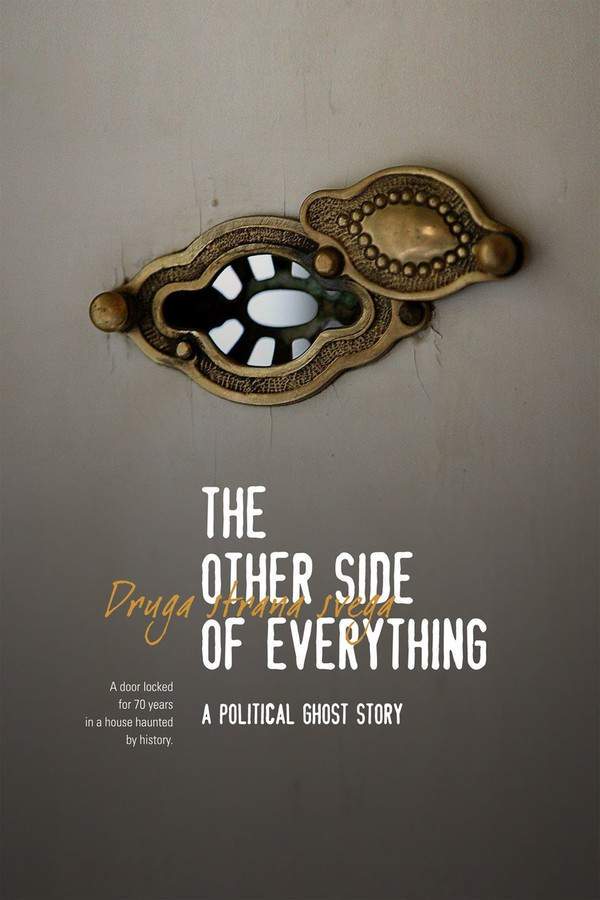

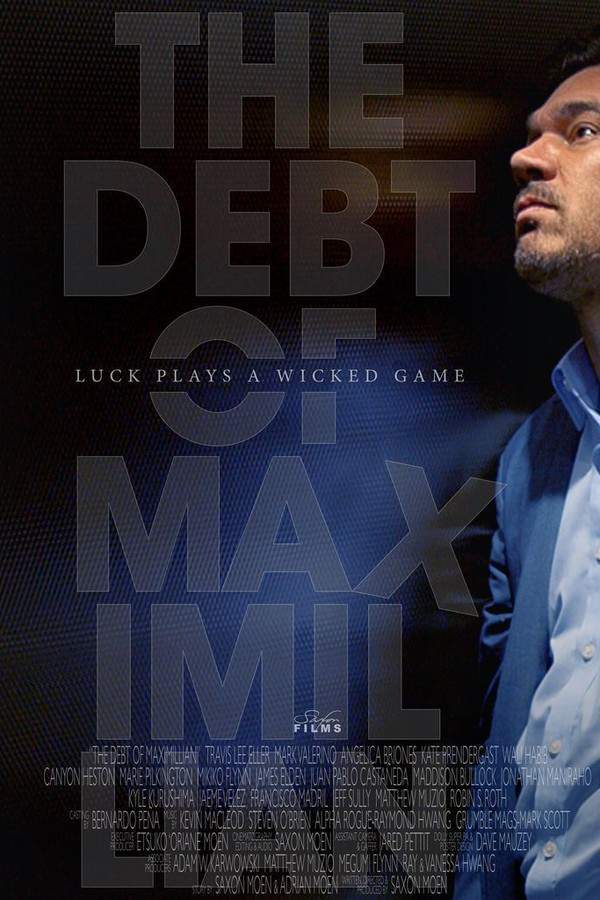

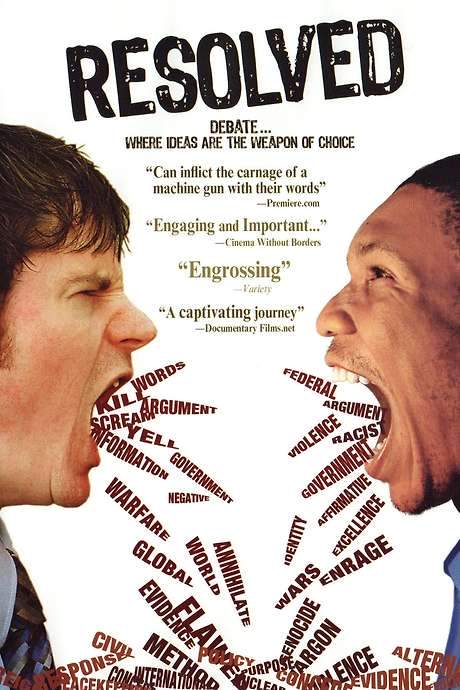

Systemic analysis dramas like Too Big to Fail

Unflinching examinations of flawed systems that leave you with uneasy questions.Fans of Too Big to Fail who appreciate its deep dive into a complex system will enjoy these similar movies. These films offer a sobering look at how large-scale systems operate, fail, and are patched up, often ending on a bittersweet note that questions the true cost of stability.

Narrative Summary

The narrative pattern involves peeling back the layers of a complex institution to reveal the interconnected causes of a major failure. The journey is one of discovery and grim realization, where solving the immediate crisis often comes at the cost of addressing the root causes, leading to an ending that mixes relief with cynicism or unease.

Why These Movies?

These films are connected by their analytical approach to storytelling, heavy emotional weight, and a shared tone of sober contemplation. They prioritize understanding a complex problem over simple heroics, resulting in a similar bittersweet and thought-provoking feeling long after the credits roll.

Unlock the Full Story of Too Big to Fail

Don't stop at just watching — explore Too Big to Fail in full detail. From the complete plot summary and scene-by-scene timeline to character breakdowns, thematic analysis, and a deep dive into the ending — every page helps you truly understand what Too Big to Fail is all about. Plus, discover what's next after the movie.

Too Big to Fail Summary

Read a complete plot summary of Too Big to Fail, including all key story points, character arcs, and turning points. This in-depth recap is ideal for understanding the narrative structure or reviewing what happened in the movie.

Characters, Settings & Themes in Too Big to Fail

Discover the characters, locations, and core themes that shape Too Big to Fail. Get insights into symbolic elements, setting significance, and deeper narrative meaning — ideal for thematic analysis and movie breakdowns.

Too Big to Fail Spoiler-Free Summary

Get a quick, spoiler-free overview of Too Big to Fail that covers the main plot points and key details without revealing any major twists or spoilers. Perfect for those who want to know what to expect before diving in.

More About Too Big to Fail

Visit What's After the Movie to explore more about Too Big to Fail: box office results, cast and crew info, production details, post-credit scenes, and external links — all in one place for movie fans and researchers.