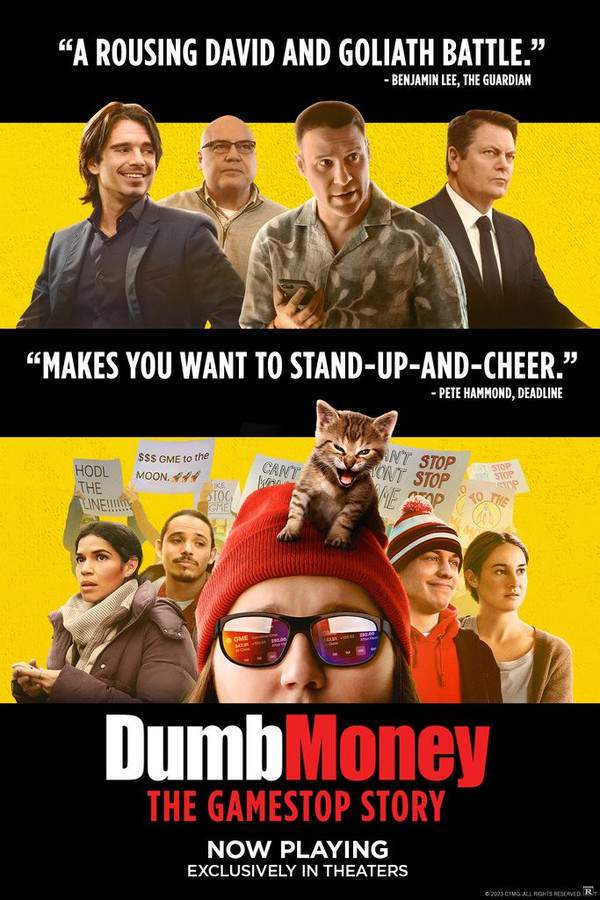

Dumb Money

Year: 2023

Runtime: 1 h 44 m

Language: English

Director: Craig Gillespie

Echo Score: 68Budget: $30M

Based on a true story, ordinary investors band together to challenge powerful Wall Street firms by investing in GameStop, a struggling retailer. Fueled by online communities, their actions trigger an extraordinary stock market surge, impacting financial institutions and captivating the world. Paul Dano portrays Keith Gill, the central figure who initiates this unexpected and chaotic phenomenon, putting everything on the line.

Warning: spoilers below!

Haven’t seen Dumb Money yet? This summary contains major spoilers. Bookmark the page, watch the movie, and come back for the full breakdown. If you're ready, scroll on and relive the story!

Timeline – Dumb Money (2023)

Trace every key event in Dumb Money (2023) with our detailed, chronological timeline. Perfect for unpacking nonlinear stories, spotting hidden connections, and understanding how each scene builds toward the film’s climax. Whether you're revisiting or decoding for the first time, this timeline gives you the full picture.

Last Updated: October 25, 2024 at 08:28

Explore Movie Threads

Discover curated groups of movies connected by mood, themes, and story style. Browse collections built around emotion, atmosphere, and narrative focus to easily find films that match what you feel like watching right now.

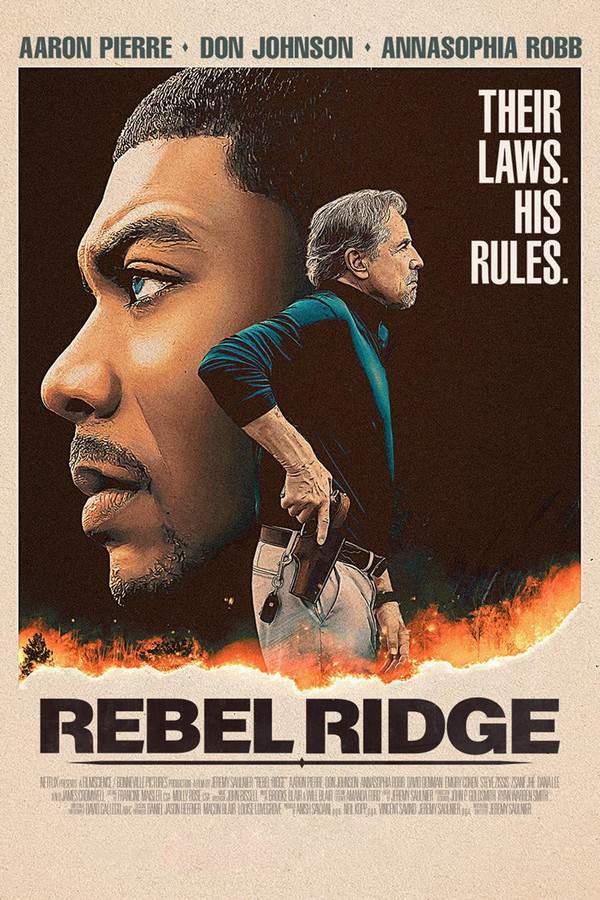

Modern Underdog Revolts like Dumb Money

Everyday people use new tools to challenge powerful, entrenched systems.Discover movies like Dumb Money where contemporary underdogs fight back. This thread collects films about ordinary people using digital tools and collective action to challenge powerful systems, featuring fast-paced stories of rebellion with tense, bittersweet outcomes.

Narrative Summary

The narrative pattern follows a grassroots movement or an unlikely leader who sparks a widespread challenge against a seemingly unbeatable foe. The journey is marked by rapid escalation, external pressure, and a mix of triumphant victories and sobering costs, reflecting the messy reality of modern rebellion.

Why These Movies?

Movies are grouped here for their shared focus on contemporary David-vs-Goliath conflicts, often fueled by technology and social dynamics. They share a tense, urgent tone and a bittersweet emotional mix of catharsis and consequence, creating a specific, relatable underdog experience.

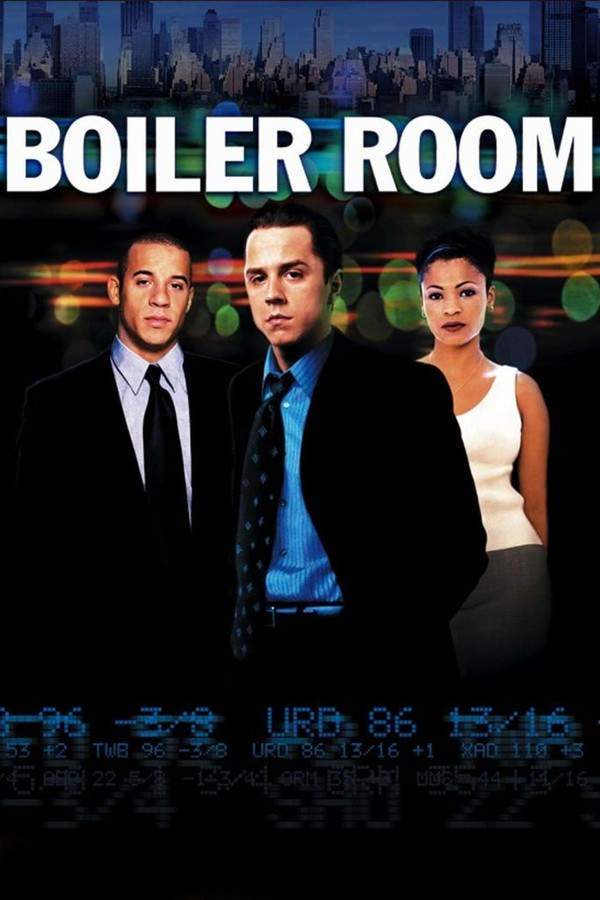

Financial Frenzy Dramas like Dumb Money

High-stakes stories where money, markets, and morality collide.If you liked the market chaos of Dumb Money, explore these financial frenzy dramas. This section features tense, fast-paced movies about high-stakes investing, market upheavals, and the personal dramas ignited by financial gambles, perfect for viewers who enjoy economic thrillers.

Narrative Summary

Narratives typically revolve around a high-concept financial event—a bubble, a short squeeze, a risky trade—that spirals out of control. The plot follows multiple perspectives, from ambitious outsiders to powerful insiders, as they navigate the chaotic fallout, exploring themes of greed, power, and chance.

Why These Movies?

These movies are united by their subject matter: the volatile world of high finance. They share a specific vibe of urgency and chaos, driven by financial mechanics and moral ambiguity. The pacing is fast, the tone is tense, and the intensity is high, creating a distinct subgenre of drama.

Unlock the Full Story of Dumb Money

Don't stop at just watching — explore Dumb Money in full detail. From the complete plot summary and scene-by-scene timeline to character breakdowns, thematic analysis, and a deep dive into the ending — every page helps you truly understand what Dumb Money is all about. Plus, discover what's next after the movie.

Dumb Money Summary

Read a complete plot summary of Dumb Money, including all key story points, character arcs, and turning points. This in-depth recap is ideal for understanding the narrative structure or reviewing what happened in the movie.

Characters, Settings & Themes in Dumb Money

Discover the characters, locations, and core themes that shape Dumb Money. Get insights into symbolic elements, setting significance, and deeper narrative meaning — ideal for thematic analysis and movie breakdowns.

Dumb Money Ending Explained

What really happened at the end of Dumb Money? This detailed ending explained page breaks down final scenes, hidden clues, and alternate interpretations with expert analysis and viewer theories.

Dumb Money Spoiler-Free Summary

Get a quick, spoiler-free overview of Dumb Money that covers the main plot points and key details without revealing any major twists or spoilers. Perfect for those who want to know what to expect before diving in.

More About Dumb Money

Visit What's After the Movie to explore more about Dumb Money: box office results, cast and crew info, production details, post-credit scenes, and external links — all in one place for movie fans and researchers.

Similar Movies to Dumb Money

Discover movies like Dumb Money that share similar genres, themes, and storytelling elements. Whether you’re drawn to the atmosphere, character arcs, or plot structure, these curated recommendations will help you explore more films you’ll love.

Explore More About Movie Dumb Money

Dumb Money (2023) Plot Summary & Movie Recap

Dumb Money (2023) Scene-by-Scene Movie Timeline

Dumb Money (2023) Ending Explained & Theories

Dumb Money (2023) Spoiler-Free Summary & Key Flow

Movies Like Dumb Money – Similar Titles You’ll Enjoy

Moneyball (2011) Full Summary & Key Details

The Big Short (2015) Spoiler-Packed Plot Recap

GameStop: Rise of the Players (2022) Story Summary & Characters

Funny Money (2007) Plot Summary & Ending Explained

Billionaire Boys Club (2018) Complete Plot Breakdown

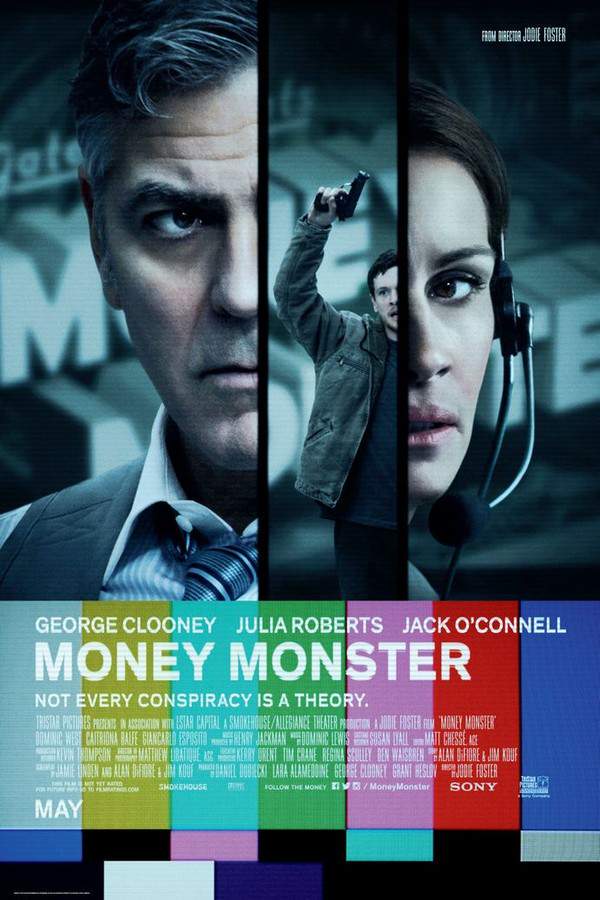

Money Monster (2016) Full Summary & Key Details

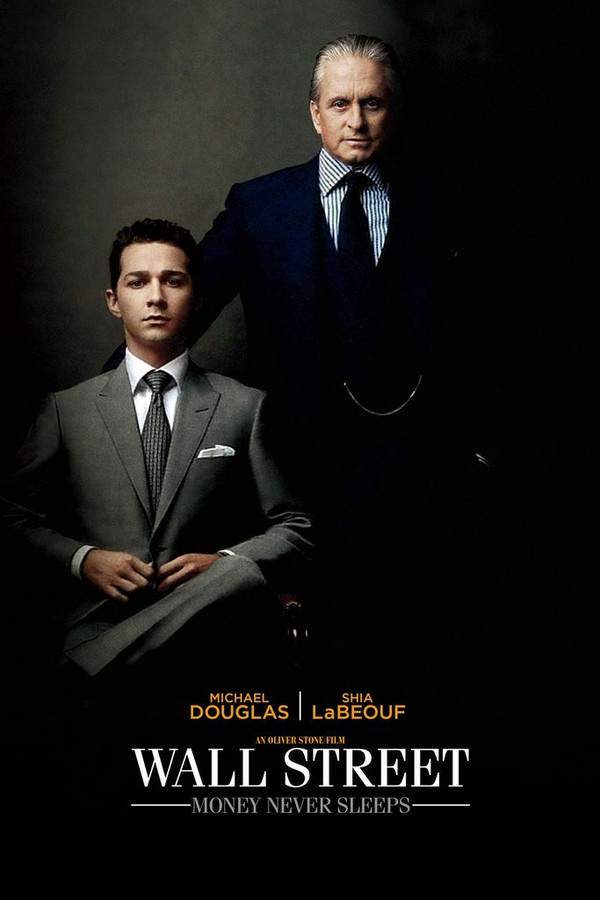

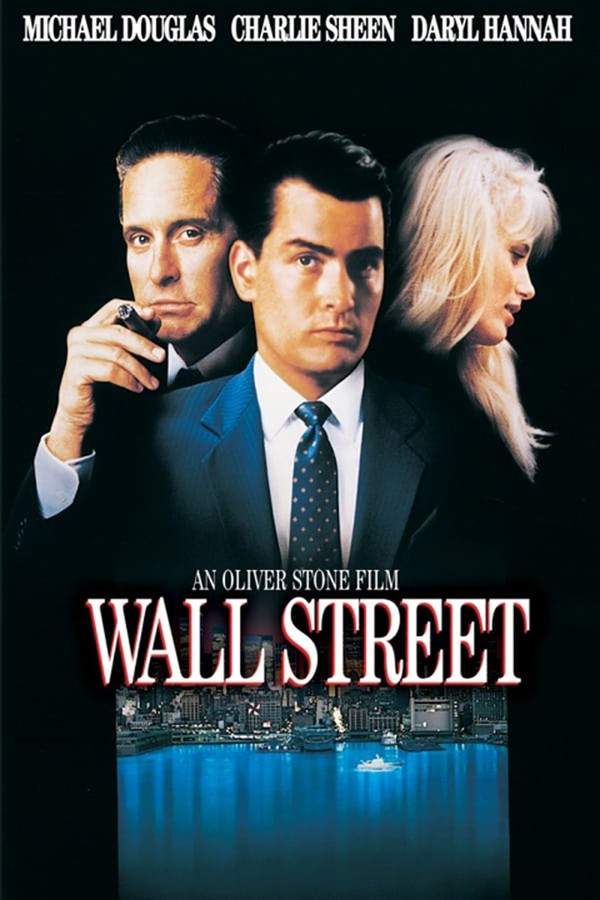

Wall Street: Money Never Sleeps (2010) Complete Plot Breakdown

For da Love of Money (2002) Story Summary & Characters

Dumbbells (2014) Film Overview & Timeline

Money (1991) Complete Plot Breakdown

Gaming Wall St (1000) Film Overview & Timeline

Gaming Wall St (1000) Plot Summary & Ending Explained

Smart Money (1931) Complete Plot Breakdown

Money Kings (1998) Movie Recap & Themes

Eat the Rich: The GameStop Saga (1000) Film Overview & Timeline