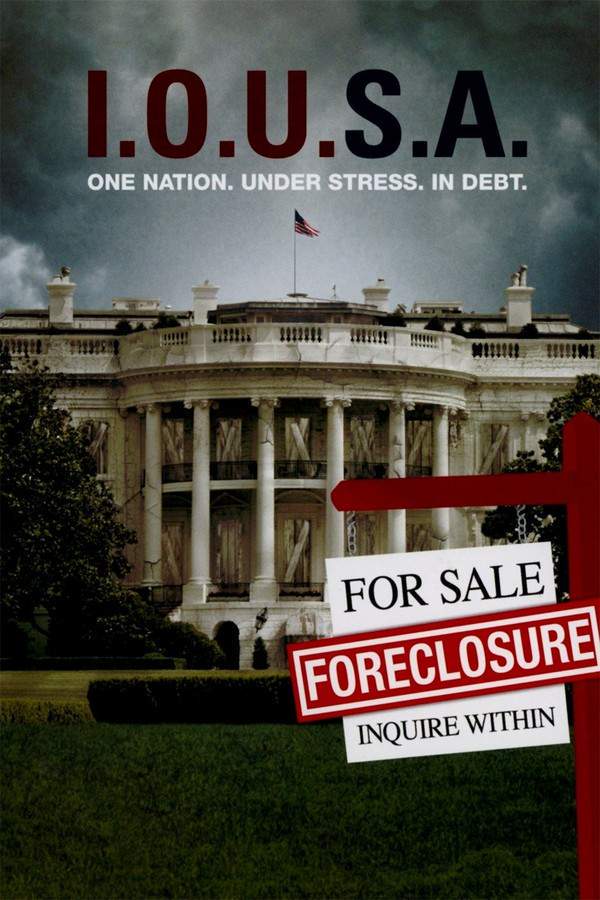

I.O.U.S.A.

Year: 2008

Runtime: 85 min

Language: English

Director: Patrick Creadon

This documentary examines the escalating national debt of the United States and its potential consequences. It explores how the debt has grown, highlighting the risks it poses to the country's financial stability and the future prosperity of its citizens. The film investigates the underlying factors contributing to this economic challenge and the potential impact on the nation's security and global standing.

Warning: spoilers below!

Haven’t seen I.O.U.S.A. yet? This summary contains major spoilers. Bookmark the page, watch the movie, and come back for the full breakdown. If you're ready, scroll on and relive the story!

Timeline – I.O.U.S.A. (2008)

Trace every key event in I.O.U.S.A. (2008) with our detailed, chronological timeline. Perfect for unpacking nonlinear stories, spotting hidden connections, and understanding how each scene builds toward the film’s climax. Whether you're revisiting or decoding for the first time, this timeline gives you the full picture.

Last Updated: November 04, 2024 at 04:31

Explore Movie Threads

Discover curated groups of movies connected by mood, themes, and story style. Browse collections built around emotion, atmosphere, and narrative focus to easily find films that match what you feel like watching right now.

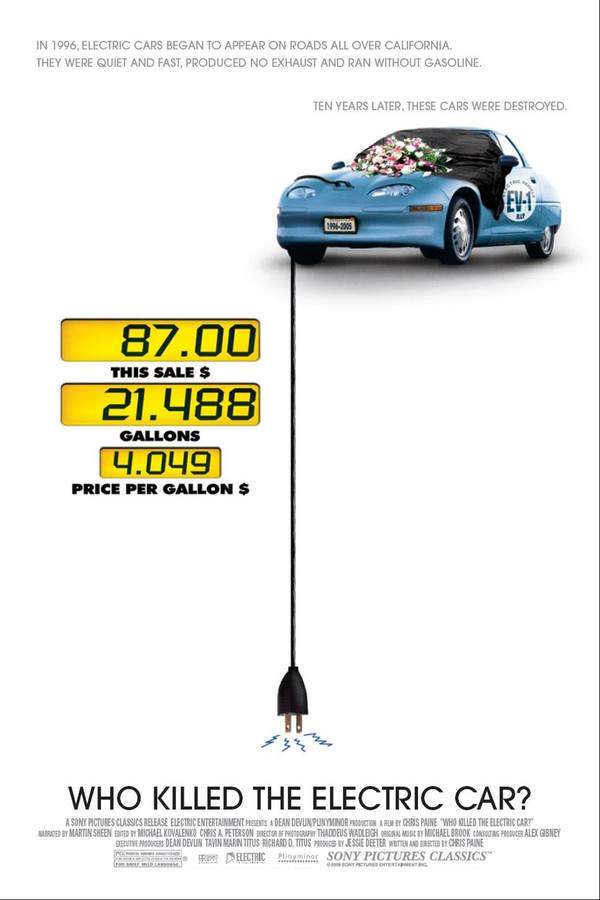

Urgent warning documentaries like I.O.U.S.A.

Investigative films that sound a sobering alarm about systemic crises threatening our future.If you liked the alarming and analytical approach of I.O.U.S.A., explore more movies that sound the alarm on critical issues. These films use a similar methodical, data-driven style to investigate systemic threats, leaving you informed and concerned about the future.

Narrative Summary

Narratives in this thread typically unfold as a mounting case study. They present a problem, trace its origins and contributing factors, illustrate its present and potential consequences, and conclude with a call to action. The journey is less about individual characters and more about the collective fate shaped by the central issue.

Why These Movies?

Movies are grouped here based on their shared purpose as clarion calls. They possess a sobering, didactic tone, a steady, informative pacing, and a heavy emotional weight derived from the gravity of their subject matter. The viewing experience is defined by a blend of tension and sadness.

Movies with methodical systemic analysis like I.O.U.S.A.

Stories that dissect a complex system, revealing its fragile parts and potential for collapse.Fans of I.O.U.S.A.'s detailed breakdown of the national debt will enjoy other films that meticulously analyze complex systems. These movies, whether documentaries or intricate dramas, share a similar vibe of intellectual discovery and underlying dread as they explore fragile structures.

Narrative Summary

The narrative pattern involves deconstructing a large, interconnected system into its component parts. The story examines each part's function, its vulnerabilities, and its relationship to the whole. Conflict arises from the system's inherent flaws or external pressures, leading to an exploration of potential failure points and consequences.

Why These Movies?

These films are connected by their analytical approach to storytelling. They share a complex narrative structure, a steady, explanatory pacing, and a tense tone that builds from the revelation of systemic risks. The experience is intellectually stimulating and often emotionally heavy due to the high stakes involved.

Unlock the Full Story of I.O.U.S.A.

Don't stop at just watching — explore I.O.U.S.A. in full detail. From the complete plot summary and scene-by-scene timeline to character breakdowns, thematic analysis, and a deep dive into the ending — every page helps you truly understand what I.O.U.S.A. is all about. Plus, discover what's next after the movie.

I.O.U.S.A. Summary

Read a complete plot summary of I.O.U.S.A., including all key story points, character arcs, and turning points. This in-depth recap is ideal for understanding the narrative structure or reviewing what happened in the movie.

Characters, Settings & Themes in I.O.U.S.A.

Discover the characters, locations, and core themes that shape I.O.U.S.A.. Get insights into symbolic elements, setting significance, and deeper narrative meaning — ideal for thematic analysis and movie breakdowns.

I.O.U.S.A. Spoiler-Free Summary

Get a quick, spoiler-free overview of I.O.U.S.A. that covers the main plot points and key details without revealing any major twists or spoilers. Perfect for those who want to know what to expect before diving in.

More About I.O.U.S.A.

Visit What's After the Movie to explore more about I.O.U.S.A.: box office results, cast and crew info, production details, post-credit scenes, and external links — all in one place for movie fans and researchers.

Similar Movies to I.O.U.S.A.

Discover movies like I.O.U.S.A. that share similar genres, themes, and storytelling elements. Whether you’re drawn to the atmosphere, character arcs, or plot structure, these curated recommendations will help you explore more films you’ll love.

Explore More About Movie I.O.U.S.A.

I.O.U.S.A. (2008) Plot Summary & Movie Recap

I.O.U.S.A. (2008) Scene-by-Scene Movie Timeline

I.O.U.S.A. (2008) Spoiler-Free Summary & Key Flow

Movies Like I.O.U.S.A. – Similar Titles You’ll Enjoy

Civil War (or, Who Do We Think We Are) (2021) Full Movie Breakdown

Inside Job (2010) Detailed Story Recap

Saving Capitalism (2017) Movie Recap & Themes

Life and Debt (2001) Story Summary & Characters

Fed Up (2014) Full Summary & Key Details

Food, Inc. (2009) Movie Recap & Themes

Maxed Out: Hard Times, Easy Credit and the Era of Predatory Lenders (2007) Spoiler-Packed Plot Recap

America: Freedom to Fascism (2006) Full Movie Breakdown

System Error (2020) Full Summary & Key Details

American Casino (2009) Complete Plot Breakdown

Death by China (2012) Complete Plot Breakdown

Panic: The Untold Story of the 2008 Financial Crisis (2018) Full Movie Breakdown

One Nation Under Stress (2019) Film Overview & Timeline

Maxed Out (2006) Story Summary & Characters

Age of Easy Money (2023) Ending Explained & Film Insights