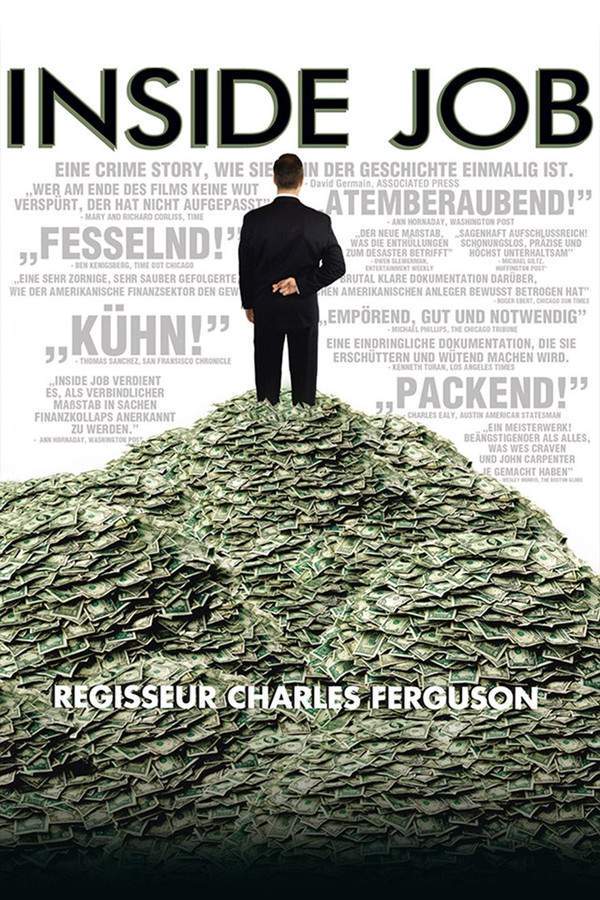

Inside Job

Year: 2010

Runtime: 120 min

Language: English

Director: Charles Ferguson

Budget: $2M

This gripping documentary examines the causes and consequences of the 2008 global financial crisis. Through extensive interviews with bankers, politicians, and economists, it explores the systemic failures and questionable practices that led to the crisis, which cost trillions of dollars and impacted economies worldwide. The film investigates the complex relationships between the financial industry, government regulation, and academic institutions, revealing the human cost of unchecked ambition and risky behavior.

Warning: spoilers below!

Haven’t seen Inside Job yet? This summary contains major spoilers. Bookmark the page, watch the movie, and come back for the full breakdown. If you're ready, scroll on and relive the story!

Timeline – Inside Job (2010)

Trace every key event in Inside Job (2010) with our detailed, chronological timeline. Perfect for unpacking nonlinear stories, spotting hidden connections, and understanding how each scene builds toward the film’s climax. Whether you're revisiting or decoding for the first time, this timeline gives you the full picture.

Last Updated: November 15, 2024 at 19:17

Explore Movie Threads

Discover curated groups of movies connected by mood, themes, and story style. Browse collections built around emotion, atmosphere, and narrative focus to easily find films that match what you feel like watching right now.

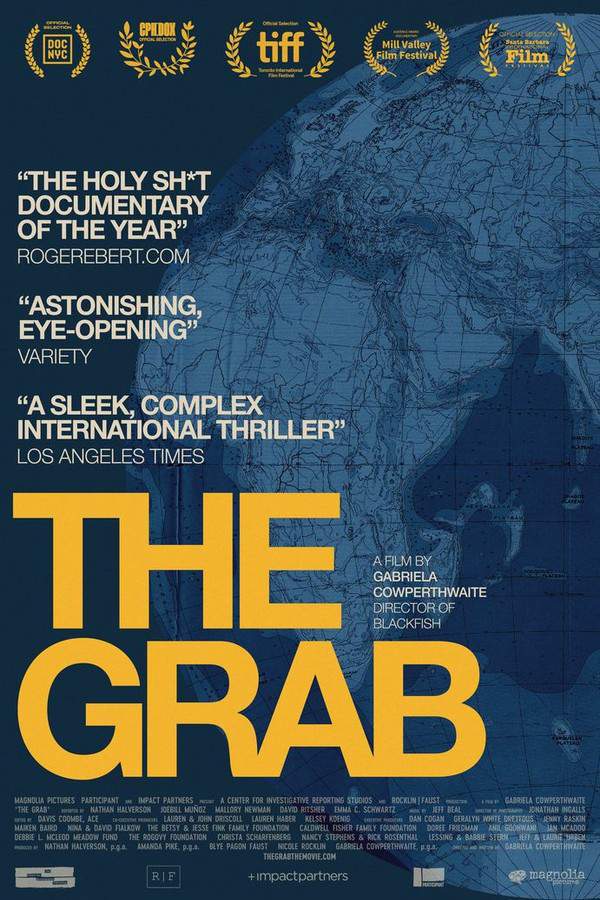

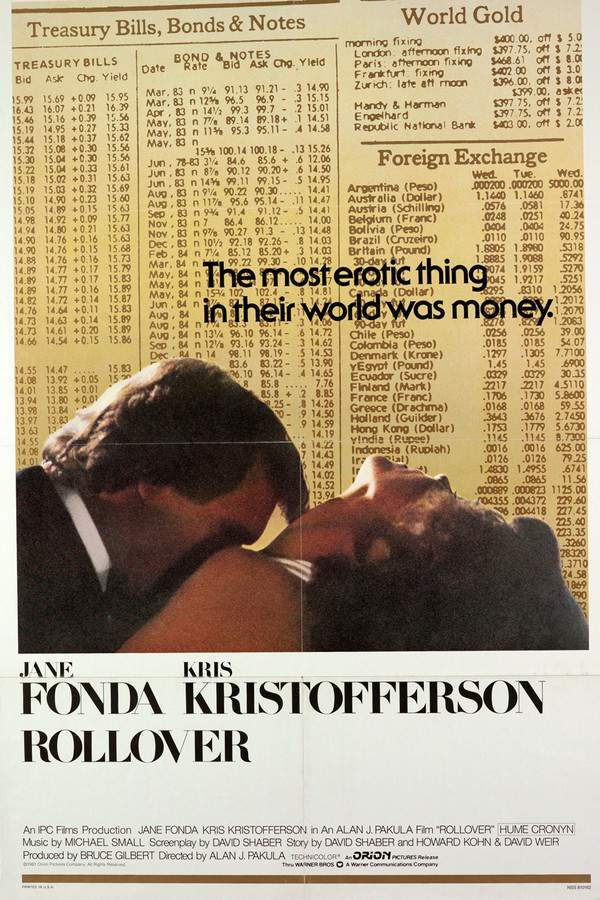

Documentaries exposing systemic failure like Inside Job

Methodical investigations that reveal the shocking truths behind broken systems.If you enjoyed the investigative rigor of Inside Job, explore more movies like it. This thread features similar gripping documentaries and dramas that meticulously uncover political corruption, corporate malfeasance, or other complex systemic breakdowns, leaving viewers with a heavy emotional weight.

Narrative Summary

Stories in this thread typically follow a logical, evidence-driven structure, often presented in distinct chapters. They build a case from the ground up, connecting dots between powerful players to reveal a larger pattern of negligence or corruption, leading to a conclusion that underscores the scale of the failure.

Why These Movies?

These films are grouped by their investigative nature, sobering tone, and focus on exposing complex, real-world issues. They share a methodical pacing, high intellectual complexity, and deliver a powerful, often bleak, emotional punch by holding a mirror to societal flaws.

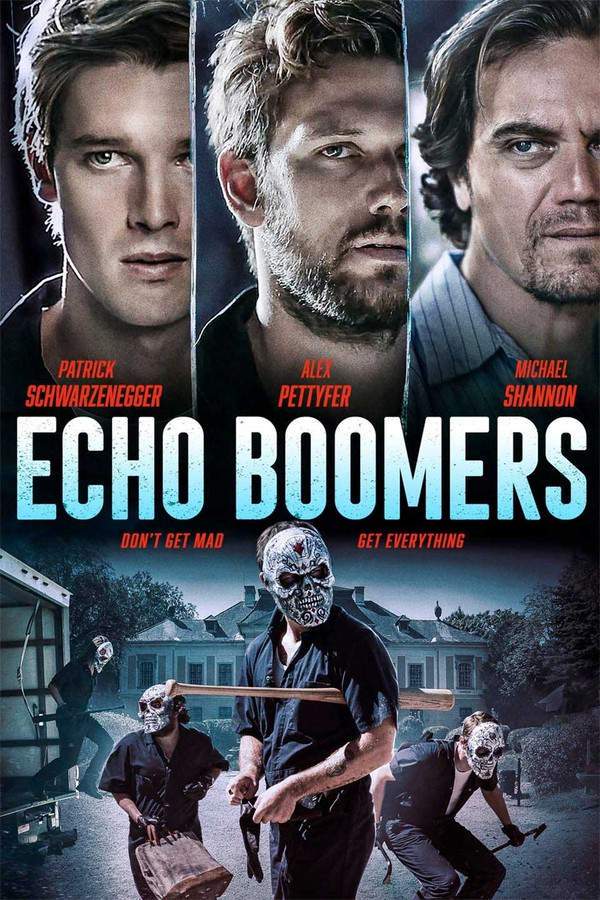

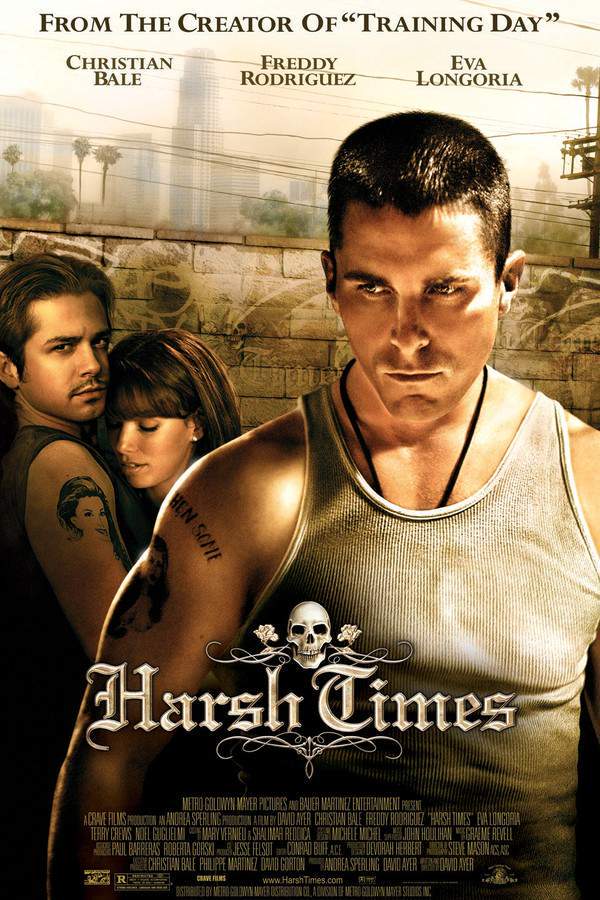

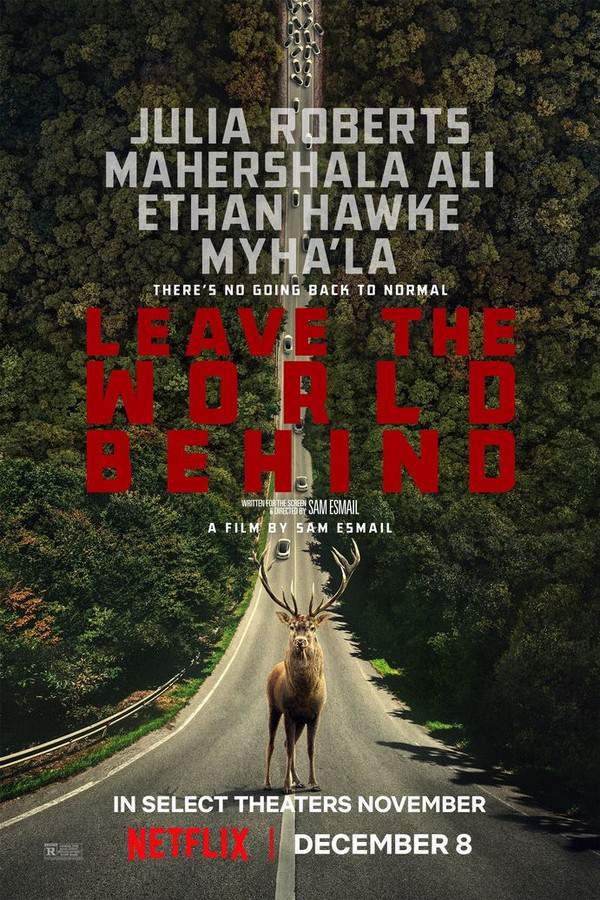

Bleak stories of ambition and collapse like Inside Job

Stories where ambition and flawed systems lead to catastrophic consequences.For viewers who appreciated the tense, bleak journey of Inside Job, this thread collects movies with a similar vibe. Find films about unchecked ambition, high-stakes consequences, and moral failings, whether they are documentaries, dramas, or thrillers, that leave a heavy impact.

Narrative Summary

The narrative pattern often involves protagonists or systems operating with unchecked power, ignoring warning signs until a point of catastrophic failure. The journey is less about redemption and more about exposing the depth of the moral rot, leading to an ending that offers little hope for meaningful change.

Why These Movies?

These movies are united by their high-tension, bleak atmosphere and heavy emotional weight. They focus on themes of greed, failed accountability, and the devastating consequences of complex systems breaking down, creating a consistent vibe of frustration and sobering realization.

Unlock the Full Story of Inside Job

Don't stop at just watching — explore Inside Job in full detail. From the complete plot summary and scene-by-scene timeline to character breakdowns, thematic analysis, and a deep dive into the ending — every page helps you truly understand what Inside Job is all about. Plus, discover what's next after the movie.

Inside Job Summary

Read a complete plot summary of Inside Job, including all key story points, character arcs, and turning points. This in-depth recap is ideal for understanding the narrative structure or reviewing what happened in the movie.

Characters, Settings & Themes in Inside Job

Discover the characters, locations, and core themes that shape Inside Job. Get insights into symbolic elements, setting significance, and deeper narrative meaning — ideal for thematic analysis and movie breakdowns.

Inside Job Spoiler-Free Summary

Get a quick, spoiler-free overview of Inside Job that covers the main plot points and key details without revealing any major twists or spoilers. Perfect for those who want to know what to expect before diving in.

More About Inside Job

Visit What's After the Movie to explore more about Inside Job: box office results, cast and crew info, production details, post-credit scenes, and external links — all in one place for movie fans and researchers.

Similar Movies to Inside Job

Discover movies like Inside Job that share similar genres, themes, and storytelling elements. Whether you’re drawn to the atmosphere, character arcs, or plot structure, these curated recommendations will help you explore more films you’ll love.

Explore More About Movie Inside Job

Inside Job (2010) Plot Summary & Movie Recap

Inside Job (2010) Scene-by-Scene Movie Timeline

Inside Job (2010) Spoiler-Free Summary & Key Flow

Movies Like Inside Job – Similar Titles You’ll Enjoy

The Emperor's New Clothes (2015) Ending Explained & Film Insights

Inside Man (2006) Full Movie Breakdown

The Big Short (2015) Spoiler-Packed Plot Recap

Saving Capitalism (2017) Story Summary & Characters

Casino Jack and the United States of Money (2010) Ending Explained & Film Insights

Enron: The Smartest Guys in the Room (2005) Complete Plot Breakdown

Master of the Universe (2014) Plot Summary & Ending Explained

Wall Street: A Wondering Trip (2005) Complete Plot Breakdown

Blurred Lines: Inside the Art World (2017) Detailed Story Recap

System Error (2018) Spoiler-Packed Plot Recap

The Men Who Stole the World (2018) Full Summary & Key Details

Panic: The Untold Story of the 2008 Financial Crisis (2018) Film Overview & Timeline

Inside 9/11 (1000) Ending Explained & Film Insights

Age of Easy Money (2023) Film Overview & Timeline

Game Over - The Fall of Credit Suisse (2025) Ending Explained & Film Insights